We’re now on element #3 in our “Secrets to Reading a Bid Sheet” series!

If you missed the other posts in the series–take a

Today, we tackle change.

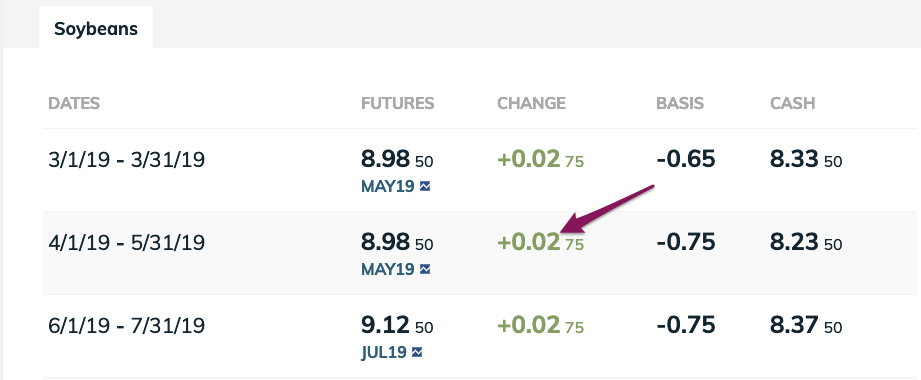

Change might seem like a simple concept and, mathematically, it is. However, on the bid sheet there are three main components of price: Futures, Basis & Cash…and that’s where the confusion comes in. Can you tell me which price component the ‘Change’ column is referring to?

Here’s your “phone a farm girl next door” life line!

The change is directly related to the movement in the futures price.

It’s helpful to remember that when talking about the markets with your farmer, you may hear him say things like, “Looks like beans are up today.” or “Well, another rough day for the corn market, finished down a penny.” In both statements, what he’s referring to is the change in the current futures price versus the settlement price from the previous trading session.

The calculation of the change on the futures contract is the difference between today’s price & the settlement price from the previous session.

Today’s Current Futures Price

–

Previous Settlement Price

=

Change

While the market is open, the change column will fluctuate as the futures price fluctuates. Once the market is finished trading for the session, the change column will be stagnant. When the market is closed, the change will show the difference between today’s futures contract settlement price and the previous trading session’s settlement price.

A positive change (AKA what all of us with a commodity to sell want to see!) indicates that the futures market is trading higher than it closed in the previous session*.

A negative change means that the futures market price is trading lower now than it previously settled in the last session.

Let’s look at an example:

If the current futures price for Dec 19 Corn on the bid sheet is $3.95 and the change column is displaying $-0.07, then the previous settlement price was $4.02. A negative change indicates a fall in prices from the previous trading session.

Calculation Example:

$3.95 (current price) – -.07 (change) =

$4.02 (previous settlement)

*”Previous session” refers to the previous trading session. Each commodity has specific hours it is open for trading. These hours can be found in the contract specs. (Contract specs can found here: corn & soybeans).

Trading Hours at a glance for corn & soybeans:

Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT and

Monday – Friday, 8:30 a.m. – 1:20 p.m. CT

Next up in the bid sheet series–we tackle BASIS. This is going to be a good one, so don’t miss it!

To be sure you never miss a beat Next Door, sign up for my weekly newsletter (sign up form is on the right side of the page!).