What impact does the Futures price have on the Cash Price I will receive?

Do you invest in the stock market? If you do, a good starting point to understanding the futures price of a commodity is to relate it to the price of a stock. Before you decide to invest in a share of stock, you’ll likely research things like company news, overall investor sentiment, market trends, recent fed policy decisions, and government and industry news that may affect the company’s future . Just like the various factors impacting the share price of a company’s stock, the futures price of a commodity is impacted by many factors.

Many factors impact the futures price including supply and demand, weather forecasts, trade agreements, technology, USDA and WASDE reports, fund buying/selling, etc. These factors are very much out of the control of an individual producer or grain buyer, just like changes in the stock price are out of your control as an investor. When the futures price moves up or down due to various factors, producers are affected across the U.S., not just your local area.

For many agricultural commodities in the U.S., such as corn and soybeans, commodities futures contracts are traded on the CME. The futures price represents the value of the commodity you are selling in the global marketplace.

If you’ve ever heard your farmer say, “the market is down (or up) today,” what they are referring to is the change in the futures price compared to the closing price of the contract in the previous trading period. (We’ll be covering ‘change’ more in depth in a post very soon!) The futures market has specified hours it is open for trading, which include a daytime session and an overnight session. Thus, if you check the markets while it’s open for trading, you will notice the price constantly fluctuates. Again, you can relate this to the movement of a company’s stock price while the market is open. Note: the trading hours listed below are for both corn and soybeans. If you’d like to check the trading hours for other commodities, they can be found in the commodity’s contract specs on the CME website.

Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT – and –

Monday – Friday, 8:30 a.m. – 1:20 p.m. CT

How futures price relates to the

Bid Sheet:

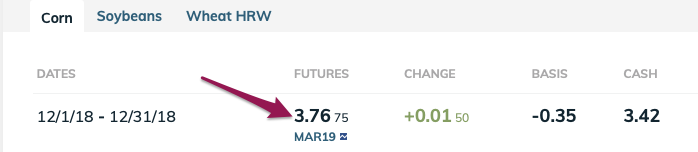

For grain buyers to determine cash price on a bid sheet, they must all start with the futures price. All grain buyers in the U.S. reference the same futures prices, which they do not have control over. For example, if a buyer in Arkansas is has a cash bid for corn and a buyer in Nebraska also has a cash bid for corn, they both use the same corn futures contract in the calculation of their cash bid.

The calculation for each bid is:

Futures + Basis = Cash

There may be several futures months listed on the bid sheet depending on the delivery periods the elevator is posting bids for. In Part 2 next week, I will help walk you through what the futures months mean on a bid sheet. For now, look over the calculation of cash price again and commit it to memory (or just bookmark this page) 🙂 Next week, we’ll build on!